franklin county ohio sales tax rate 2019

A county-wide sales tax rate of 16 is applicable to localities in Franklin County in addition to the 65 Washington sales tax. To learn more about real estate taxes click here.

Income Tax City Of Gahanna Ohio

Unclaimed Funds FAQ.

. Franklin County in Ohio has a tax rate of 75 for 2021 this includes the Ohio Sales Tax Rate of. BUDGET. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange.

The Ohio state sales tax rate is currently. The current total local sales tax rate in Franklin OH is 7000. The Franklin County Sales Tax is 16.

The minimum combined 2022 sales tax rate for Franklin Ohio is. Mandarin Chinese Restaurant Lahore. This is the total of state county and city sales tax rates.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. 23 rows The Franklin County Sales Tax is 125. The current total local sales tax rate in Franklin.

During this time all parcel. 075 lower than the maximum sales tax in OH. - The Finder This online tool can help determine the sales tax.

6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. This is the total of state and county sales tax rates. HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306.

A county-wide sales tax rate of 125 is. Cultural Services Community Enrichment. Tax Rate Share.

3 rows Franklin County OH Sales Tax Rate. There were no sales and use tax county rate changes effective October 1 2022. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

OH Sales Tax Rate. The Ohio sales tax rate is currently. The 725 sales tax rate in Franklin Furnace consists of 575 Ohio state sales tax and 15 Scioto County sales tax.

There is no applicable city tax or special tax. The Columbus Convention and Visitors Bureau Promoting the City 168 3294. Unclaimed Funds Search.

Routine maintenance on the Franklin County Treasurers Office computer system will be conducted Friday November 4th from 500 pm. You can print a 7 sales tax table here. The County sales tax rate is.

Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. The minimum combined 2022 sales tax rate for Franklin County Ohio is. If you need access to a database of all Ohio local sales tax.

ESTATE TAX FILING. Map of current sales tax rates. Ohio state sales tax.

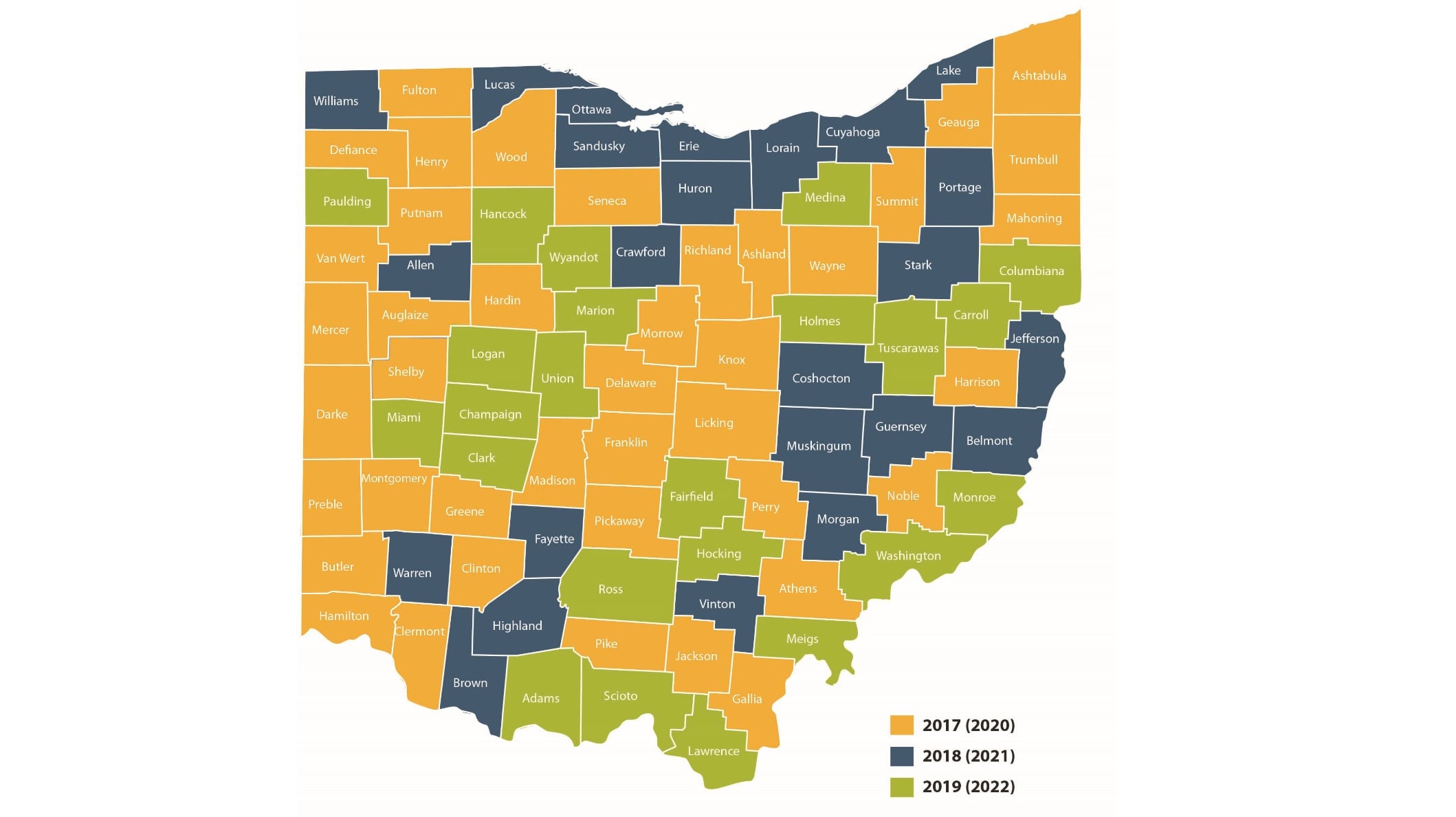

Franklin County sales tax. Franklin County Ohio Sales Tax Rate 2019. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business.

9 Graphical Things To Know About Gov Kasich S Ohio Budget Proposal Cleveland Com

Ohio Lands Among States With Lowest Taxes In Cellphones Ohio Thecentersquare Com

Maine Sales Tax Rates By City County 2022

The Blade Toledo S Breaking News Sports And Entertainment Watchdog

Florida Sales Tax Rates By City County 2022

Franklin County Ohio Ballot Measures Ballotpedia

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Franklin County Experiencing Delays On Property Tax Rates Bills

Excise Taxes Excise Tax Trends Tax Foundation