child care tax credit schedule

Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC is a refundable income tax credit that was enacted in the. If your income is 45500 your rate will be 55.

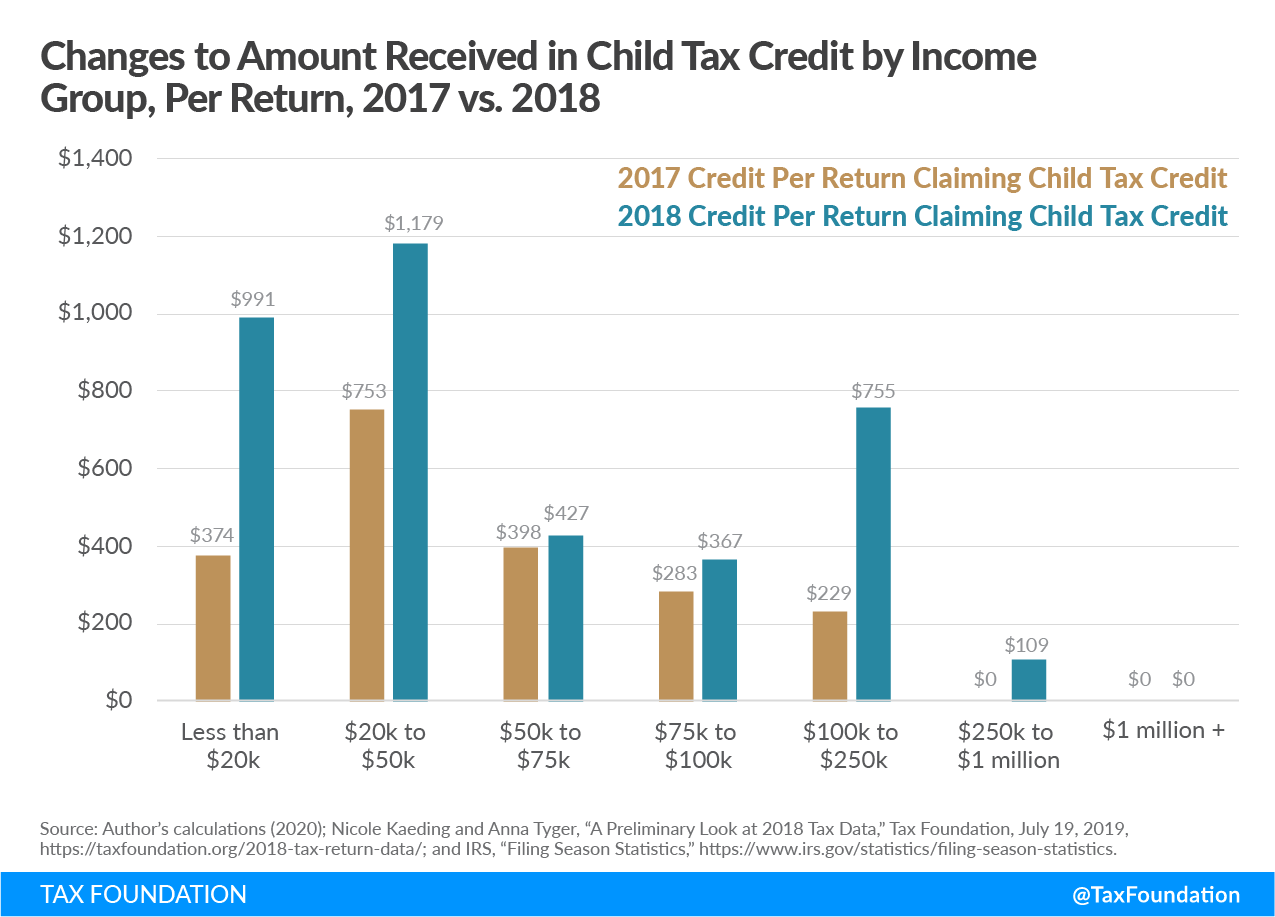

The Child Tax Credit Research Analysis Learn More About The Ctc

Ontario Child Care Tax Credit rate calculation.

. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. To reconcile advance payments on your 2021 return. 50 of the total amount spent establishing and operating a child care facility in conjunction with other businessesorganizations primarily used by dependents of the.

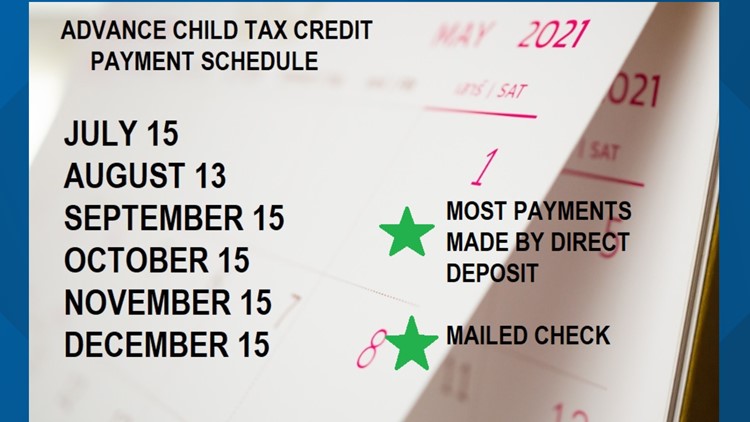

Here are the official dates. However you may still. Child care tax credit schedule.

Dates for earlier payments are shown in the. 15 opt out by Aug. For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75.

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Get your advance payments total and number of qualifying children in your online account. 15 The payments will be made either by direct deposit or by paper check depending on what.

For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. Canceled checks or money orders. Child tax credit payment schedule for 2021.

You will need the following information if you plan to claim the credit. Child tax credits of up to 3600 per child and the earned income tax credit worth up to 1502 for childless workers which goes up. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. The Instructions for Form 2441 explain the. While a 300 monthly child tax credit is far from the average monthly childcare center cost of 89658 and 65725 for family-based childcare center President Biden has.

The next payment goes out on sept. The credit is calculated. To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses.

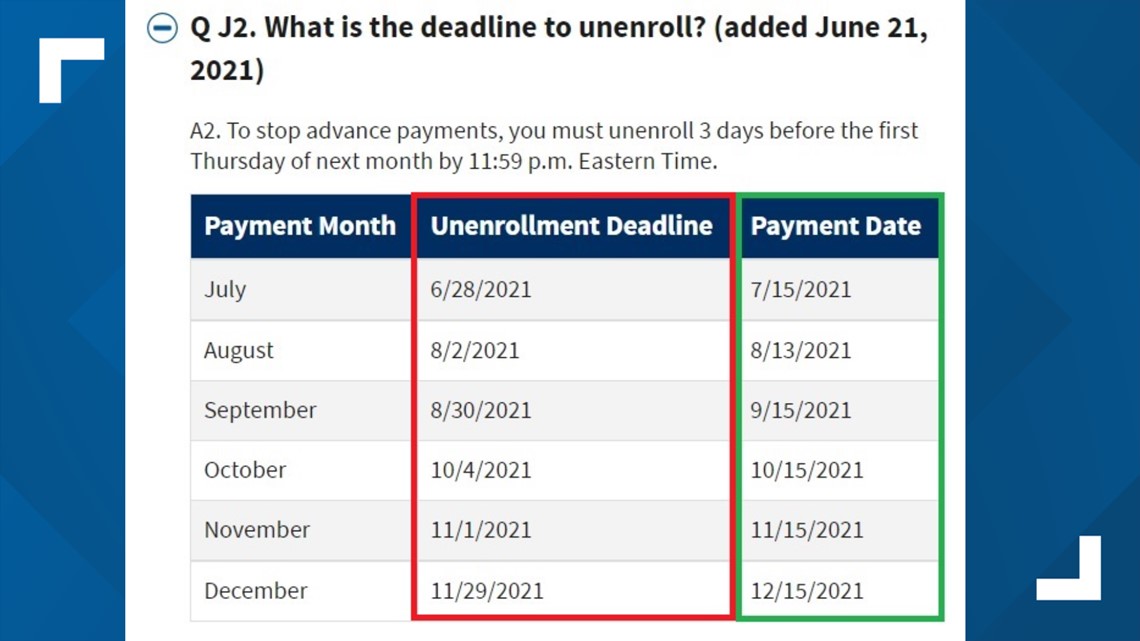

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

13 opt out by Aug. For people who paid for a daycare center babysitter summer camp or other care providers to care for a child under age 13 or a disabled dependent of any age they are eligible. Depending on their income taxpayers could write off up to.

Cash receipts received at the time of payment that can be verified by. So if a married couple owes 4600 for the prior years tax a child. Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth.

Enter your information on. The tax year 2023 maximum Earned Income Tax Credit amount is 7430 for qualifying taxpayers who have three or more qualifying children up from 6935 for tax year. Live TV Schedule.

Up to 4000 for one qualifying person for example a dependent.

Colorado Child Care Contribution Tax Credit Roundup River Ranch

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

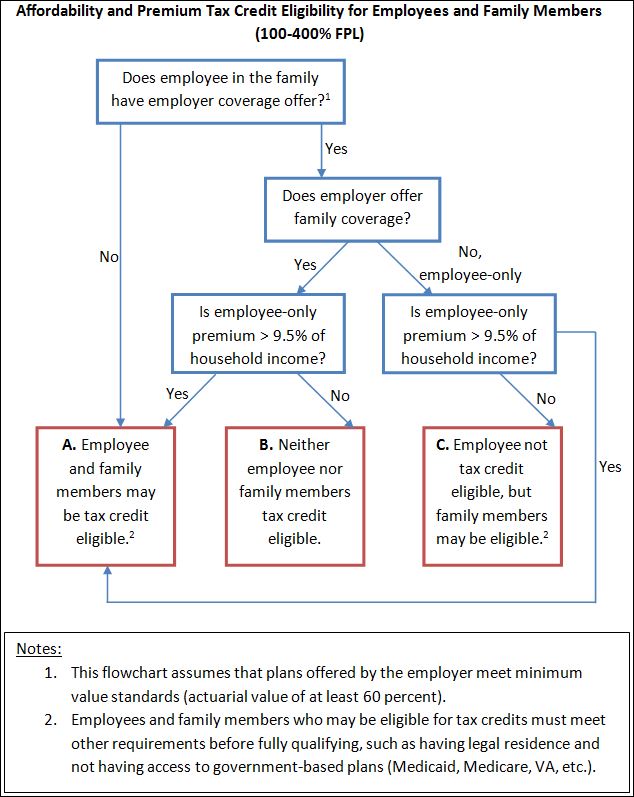

The Most Confusing Source Of Premium Tax Credit Eligibility Made Simple In One Chart The Incidental Economist

Kuow The Expanded Child Tax Credit Is Here Here S What You Need To Know

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

Describes New Form 1040 Schedules Tax Tables

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Dependent Care Tax Credit Atlanta Support Lawyer Smyrna Georgia Divorce Attorney Meriwether Tharp Llc

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return Kiplinger

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

The Child Care Tax Credit Is A Good Claim On 2020 Taxes Even Better For 2021 Returns Don T Mess With Taxes

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Payment Schedule Is Out Now Here S When You Ll Get Your Money