south dakota property tax abatement

The forms are also available to download through the South Dakota State website. A County Auditor needs to know the Taxable Value of the taxing entity from the growth form and its current Tax Requested.

Get Real About Property Taxes 2nd Edition

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-.

. South Dakota is ranked number twenty seven out of the. To qualify the following conditions must be met. Property taxes in South Dakota can be levied by any of the following tax authorities.

South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. Applications are accepted from May 1 to July 1. Wind solar biomass hydrogen hydroelectric.

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate. Enter only your house number. 10-18-2 Compromise abatement or rebate of uncollectible tax--Circumstances in which authorized-.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Email the Treasurers Office.

CHAPTER 10-18 PROPERTY TAX ABATEMENT AND REFUNDS 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. However five-year property tax. Request Value Tax Rate.

South Dakota Department of Revenue. Go to the Property Information Search. Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds.

School districts cities townships counties water districts and additional special districts for specific purposes such as fire protection or sanitary systems. Pay Property Taxes Online. In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials.

2012 South Dakota Codified Laws Title 10 TAXATION Chapter 18. Section 10-18-1 - Invalid or erroneous assessment or tax--Claims for abatement or. 2021 South Dakota Codified Laws Title 10 - Taxation Chapter 18 - Property Tax Abatement And Refunds.

Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent. South Dakota Codified Laws 10-18. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

1 COUNTY AUDITOR OFFICE Print. 2011 South Dakota Code Title 10 TAXATION Chapter 18. The head of the household must be sixty-five years of age or older or shall be disabled prior to January first of the year in.

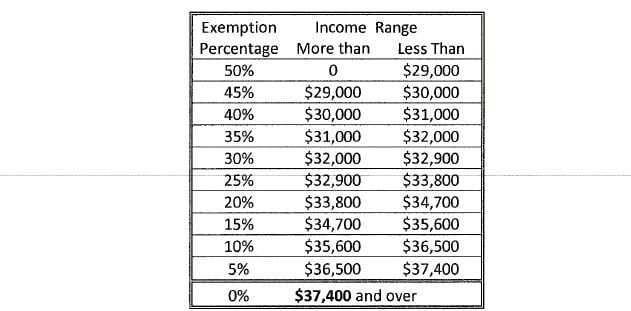

Please submit your request to the Department of Revenue Special Tax Division 445 East Capitol Avenue Pierre SD 57501-3185. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in making application. Then the property is equalized to 85 for property tax purposes.

Physical Address 104 N Main Street Suite 100 Canton SD 57013-1703. PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers. A proposal to alter the text of a pending bill or other measure by striking.

Tax amount varies by county. 128 of home value. 2014 South Dakota Codified Laws Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-.

Taxes are based on a homes true market value which is determined annually by the county. You can look up current Property Tax Statements online. 10-18-11 Time allowed for abatement or refund of invalid inequitable or unjust tax.

Look up statements online.

Tax Abatement How Does It Help You Save On Property Taxes Mybanktracker

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

Together Louisiana Keep Itep Local Petition To La Legislature

Lowering New Hampshire Property Taxes Challenging Assessment Value

States Cut Taxes For Income Gas Property And Groceries Money

South Dakota Military And Veterans Benefits The Official Army Benefits Website

Do You Know Your Homestead Exemption Deadline

Sales Taxes In The United States Wikipedia

Webster Area Development Corporation Financing Incentives

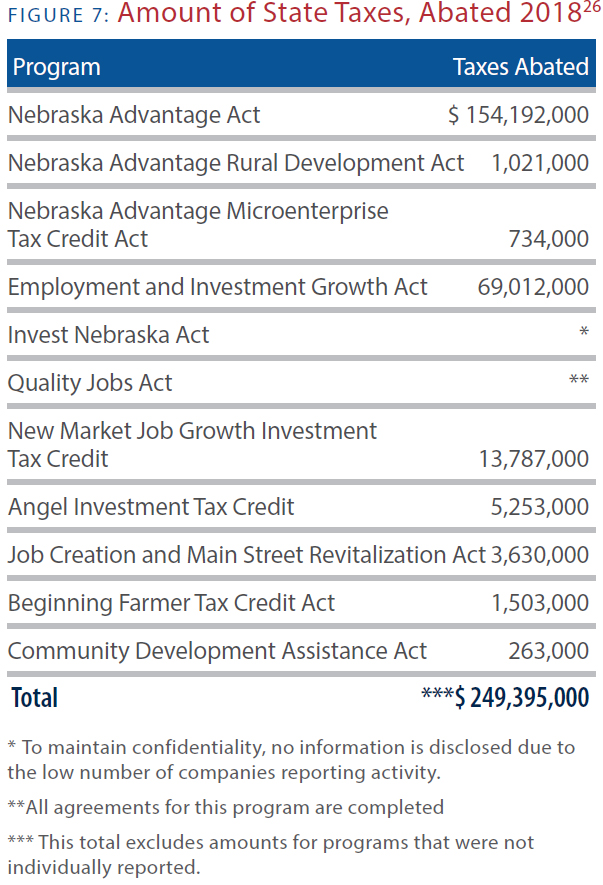

Veteran Tax Exemptions By State

Veterans Benefits 2020 Most Popular State Benefit Va News

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

2022 Property Taxes By State Report Propertyshark

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com